Silicon Valley Bank: Bespoke, Woke, and Restoked?

As these things tend to, the collapse of Silicon Valley Bank (SVB) has given rise to a host of wide-ranging discussions. Again comes a long weekend of fear and conjecture, so familiar to anyone remembering Lehman weekend, the guiding of Bear Stearns into JP Morgan’s commercial embrace, airlines dropping like flies after September 11, jitters over the fate of Long-Term Capital Management in September of 1998, and so many others. And yet, by the time I was just finishing this writing, the situation had (at least temporarily) abated.

Let’s start at the beginning. What happened?

A Classic Mismatch

First: This is not a case involving bad assets. It also, at least so far, does not seem to be one of fraud or intentional misdoing (that, as always, may change.) SVB was felled, fundamentally, by a duration gap. A duration gap is a measure of interest risk and the product of an asset-liability mismatch. When short-term liabilities fund long-term assets, such as US Treasury and agency bonds in the case of SVB, rising interest rates can generate tremendous losses. Rates on short-term liabilities are variable, while the income generated by the long-term assets (bonds and agencies owned) are fixed.

A look at the one year shift in the US yield curve depicts the one year changes in the US Treasury yield curve concisely. The yellow line is the yield curve on March 1, 2022, and the green line is the yield curve on Friday, March 11, 2023.

While this simple illustration does its job, in reality, the circumstances for SVB and institutions like it are worse. The actual short-term liabilities, bank deposits, tend to be costlier than the short-term Treasury obligations that compete with them. To accumulate deposits, banks must offer higher rates of interest than such instruments and compete with rates being paid on deposits at other banks. Most importantly, the increase in yields is associated with losses on the bonds, which manifests as deep losses to the financial institution’s equity. Although the one-year change in 20- and 30-year US Treasury yields was small, the impact on the prices of those bonds was abysmal. Last year, the longest-dated US Treasuries lost over 39 percent of their value. In addition to those losses, the illiquidity of off-the-run (aged) bonds with long maturities is notorious. Prices of mortgage securities also cratered as interest rates rose from just under 2 percent to over 6 percent. Additional losses were likely sustained amid efforts to liquidate them.

Typically, banks attempt to address duration gaps by anticipating interest rate changes and their effects in advance. Some use interest rate swaps, trading away fixed interest payments for payments that “float” along with rising rates. For others, a process called immunization (too soon?) is undertaken which changes the composition of the portfolio to decrease the mismatch, minimizing or eliminating a gap in duration. SVB was in the midst of attempting such a shuffle, but as the losses associated with several early bond sales became known and capital-raising alternatives were proposed, $42 billion in deposits fled with near instantaneity.

The good news is that SVB’s problems are largely idiosyncratic. Like most regional banks, SVB’s depositor base was much less diversified than nationwide banks. But in the case of SVB, that narrow exposure came in the form of its depositor base being concentrated in tech start-ups, a type of firm that not only burns through cash, but quickly and at an unpredictable rate. Consequently, SVB had a more tenuous, volatile deposit base than many of its regional bank peers elsewhere in the United States. Additionally, those start-up firms are tethered together by a handful of large venture capital (VC) firms which advise them, leading to herding behaviors. This was a factor as well. As rumors about SVB’s health began to spread in the last few days, VCs apparently told their portfolio firms to shift their deposits elsewhere — which they did, en masse.

A Predictable Bray

No sooner does a firm keel over than calls for a bailout or some other government rescue ring out. The effrontery that attends the call to hurl taxpayers beneath the wheels of the business failure bus is perhaps the most enduring dividend of a chain of government rescues beginning with the Penn Central loan guarantees in 1970. While the early, official comment from Treasury Secretary Janet Yellen is that there will be no bailout, as of this writing (5pm Sunday March 12, 2023) various sources are reporting depositors lining up at a number of other banks in SVB’s geographic and commercial ambit. While SVB is not a systemically significant financial institution, it’s worth mentioning that vast numbers of banks have large holdings of long-bonds purchased at record high prices and rock-bottom interest rates. Although the majority of them are not likely to be as precariously situated as SVB and its dubiously viewed neighbors are, a systemic problem of some magnitude may still lurk below the surface.

A few additional words which, in a few days or weeks may, and hopefully do, prove irrelevant.

Government rescues are frequently marketed as having been profitable or, at the very least, not losing taxpayer money. Those claims are best taken with the proverbial grain of salt. First, because if that’s true, it’s purely accidental. However marketed, bailouts usually occur under duress and little (if any) economic calculation accompanies them. They tend not to be cost-effective in light of the risk taken. And even if they are, it doesn’t matter. It’s not as if I will receive a check for my portion of the rewards reaped. There’s no conceivable reason why I, living 3,036 miles from Silicon Valley, should contribute even the meagerest financial support to a regional bank, much less to one that had an extraordinarily concentrated deposit base and was negligently slow to attempt to immunize its bond portfolios.

Some Silicon Valley start-ups may not be able to make payroll? That’s unfortunate. Certain VC portfolios may suffer damaging writedowns? That, too, is a shame. Many non-tech firms that service high tech clients — caterers, cleaning services, headhunters, accounting practices — may see their businesses irreparably harmed? Possibly. Hopefully these are all temporary setbacks. In some cases, they will not be. Yet I am aware of nothing under the sun that obligates anyone, anywhere, to sacrifice so little as a Continental dollar to alleviate their circumstances, whether they were aware of the possibilities or not.

Too-big-to-fail has arguably become a competitive advantage, if the number of times that SVB being the “13th largest bank in America” was repeated over the weekend is any indication. Moral hazard is sewn into the fabric of American business culture now. And that’s all the more reason to let these banks fail sloppily, invite better-run competitors to acquire their remnants, and allow depositors to feel the full ramifications arising with the indefinite restitution of funds beyond the FDIC guarantees. It is in that way, and that way alone, that lasting lessons are learned. For a few generations, anyway.

The Alms of Wokeness

In the post-FTX world, no account of corporate incompetence or wrongdoing is complete without a review of the subject’s political activism. In the case of SVB, a line that figured prominently on the values page of the website (before it was replaced by the sterile FDIC receivership page) is that “[they] take responsibility.” About that, we shall see.

More interestingly, the SVB website spared no opportunity to trumpet a commitment to gender, race, and ethnicity within their workforce and senior-executive ranks. It did so in an appropriately data-effusive manner including percentages, charts, and the like. Another quantitatively intensive page, explaining its Greenhouse Gas/carbon footprint policy, did so as well. One wonders, if some of that computational power had been directed at conducting simple “what-if” simulations regarding the future path of interest rates, would a greater calling have been fulfilled?

On Twitter over the weekend, an account (now locked) commented that

[t]he SVB collapse has been devastating in more ways than one: They supported women, minorities, & the LGBTQ community more than any other big bank.This includes not just diverse events, but actual funding. SVB helped us move one step forward; without them, we move two steps back.

Those sentiments deftly dismiss the more salient issue: SVB was a mismanaged bank. Whatever communities it served so faithfully in the past are now facing the uncertainties associated with fiscal maladministration. Maladministration, one finds, is exactly like its victims: unbiased, genderless, raceless, and ageless. Clients of many banks which focused on risk management, instead of leftist ideologies, slept soundly this weekend.

It’s likely that over the past weekend SVB depositors were as pleased with their bank’s deep commitment to diversity, equity, and inclusion as individuals with funds in FTX brokerage accounts were to learn about Sam Bankman-Fried’s devotion to “effective altruism.” And while it will be likely derided as a specious association, it is curious that virtually all of the firms which have recently detonated in spectacular fashion were devout standard-bearers of the environmental, social, and governance (ESG) doctrine. Perhaps wounded and hamstrung depositors, employees of firms dependent upon those deposits, and the many vendors, suppliers, contractors, and other businesses impacted by the bank’s implosion will find solace in knowing that (although their money is either lost or will be inaccessible for some period of time) SVB was included in Bloomberg’s Gender-Equality Index for five years running.

In Flux…This Very Moment

I’d written, “The SVB story is as fluid as these come and will develop on an hourly, rather than a daily, or weekly, timeframe.” And as soon as I wrote those words, I was informed of an announcement made jointly by the US Treasury, the Federal Reserve, and the FDIC. Evidently another financial institution, Signature Bank, was closed by regulators today. And, more crucially, SVB depositors will have access to their entire account balances tomorrow. Does this set a new precedent, whereby FDIC deposit insurance limits ($250,000 per account) are perfunctory? The Fed also indicated that it will make additional funds available as necessary through a Bank Term Funding Program (BTFM) backstopped by the Treasury’s Exchange Stabilization Fund. Is this a de facto return to monetary easing, to some extent or another? Does this development signal the beginning of the end of the Fed’s attempt to quash inflation, or serve as a nudge toward shifting the goalposts to an above-2-percent-per-annum inflation target?

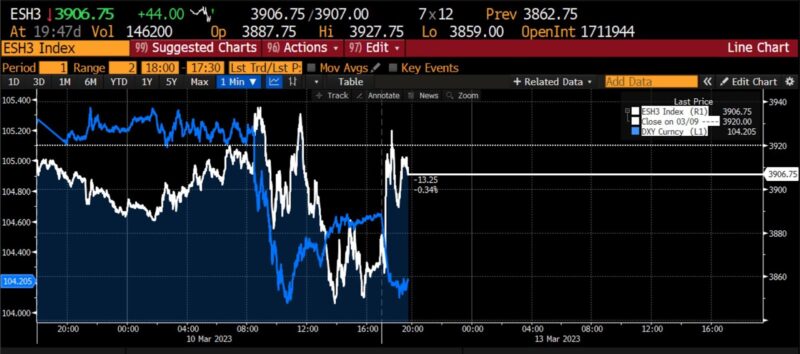

S&P March 2023 E-mini Futures vs. DXY Index (Sunday evening, 12 March 2023)

In a chorus which has become familiar, the S&P 500 futures just leapt upward, as the dollar fell with equal fervor. Relief for equities, a snub to the greenback. At 7:45pm EDT on an otherwise quiet Sunday night in March, this is what that kicking the can down the road looks like.

The post Silicon Valley Bank: Bespoke, Woke, and Restoked? was first published by the American Institute for Economic Research (AIER), and is republished here with permission. Please support their efforts.